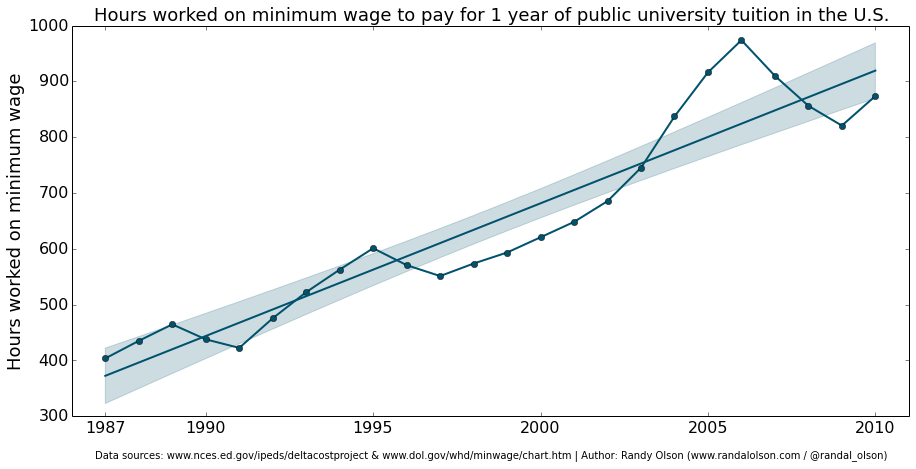

It is simply impossible for a student to work a full-time job and pay for tuition.

The average full-time student needs to work more than 900 hours to pay for one year of tuition and fees. In 1979, for the same person, only 182 hours were needed.

Randal Olson, a graduate research assistant at Michigan State University, originally reported the data after a conversation with his grandfather.

“It’s a topic that many Millennials have in the back of our mind, really,” Olson said. “The [original] post and the accompanying analysis were inspired by a conversation with my grandfather: He was explaining to me why it was such a great thing that I worked my way through college, when all I remembered was struggling to juggle classes, homework, and a job while keeping my grades up.”

Olson omitted other factors such as books and more as he feared “the plot would only look even more dismal if I factored those costs in.”

Concerns over the affordability of higher education are an ongoing national concern amongst Americans. A Gallup poll, released on April 16, said 79 percent of Americans said college was expensive for families.

Olson analyzed the changes in the federal minimum wage, which is currently $7.25 per hour. The last it was raised by the U.S. Congress was in 2009 from $6.55.

John Schmitt, an economist with the Center for Economic Policy and Research, released a report in 2012 declaring the minimum wage was too low. If it kept up with inflation, then it would be, in 2012 dollars, $9.22 per hour. If it kept up with full productivity rates, then it would be, also in 2012 dollars, $21.72 per hour.

Olson noted how the idea of working a job and paying for tuition is not a new phenomenon for Americans.

“I think it’s ingrained in the American mentality. Many of us want to believe that if we work hard enough, we can accomplish anything we set our minds to. These findings show that in some cases, the odds are stacked against us and hard work alone won’t cut it,” Olson said.

Jemal Rahyab, a senior majoring in history, believes it is difficult for any incoming college student to obtain a high-paying job to pay for school, which forces them to take minimum wage jobs.

“Many freshmen who enter college never held a job before so they are forced to work minimum wage jobs. Employers are not always understanding they hire students because they know students are desperate and need jobs, which is why they ask students to work just under full-time status like 35-38 hours a week to avoid benefits,” Rahyab said.

Moreover, Rahyab said a minimum wage job was not a guarantee to pay for tuition.

“Even if a full-time student works at a minimum wage job and saves up all the money, the student still wouldn’t be able to pay off their tuition in full for that semester,” Rahyab said.

Olson stressed that the problem may get worse, as tuition rates and enrollment rates are projected to increase over the next few decades.

Still, he emphasized how important it was for students to look into alternatives, such as trade school, scholarships, community college and the military. In addition, he criticized the “study what you love” approach as detrimental for the future of college students.

“‘Study what you love’ is the worst advice I’ve ever heard; I know dozens of college graduates who ‘studied what they love’ and now they’re stuck with a worthless college degree and overwhelming student loan debt because ‘what they love’ isn’t what employers want to pay them for. Most of the time, it’s better to get a degree in something that will land you a stable job and you can pursue what you love as a side project,” Olson said.